We’re usually talking to you about how you can blow your tax return, but today we’re reminding you to be responsible. Take some time during the holiday weekend for a quick financial tune-up of sorts. Because tax season is upon us. And filing your return can be, at best, annoyingly dull and, at worst, frighteningly daunting. Regardless of your income bracket, you never want to pay more than you need to but you certainly don't want to screw up, especially if you're not familiar with the current rules and regulations.

Failing to understand the tax code can mean you'll miss out on beneficial breaks and deductions or getting slapped with late-payment charges. Abby Eisenkraft, a New York-based tax expert and IRS enrolled agent told US News & World Report, "Last year, with the 2018 tax filing, we saw the IRS attempt to minimize the tax return to a postcard size ... of course, this 'postcard' had to have six additional schedules with it, and both taxpayers and preparers were not huge fans of this new reporting." This time around, for the 2019 tax filing, Eisenkraft says the tax return is a little longer than it was a year ago, but it now only has three additional schedules—which should make it easier to fill out.

Here's everything you need to know in order to prepare for an easy tax filing.

Not Filing Is Worse

Than Not Paying

According to Bill Smith, managing director of financial consulting firm CBIZ, you don't want to be late when it comes to filing your return. If you're hesitant because you don't think you'll be able to pay, know that you can always request a deferment or payment plan. The penalty you'll be hit with for failing to file is far more than the penalty for failing to pay. Smith says that while there is no failure-to-file penalty on returns that are due a refund, you shouldn't procrastinate. After three years, all refunds are forfeited.

Note: If you need more time, you can request a filing extension to October 15, 2020.

Fully Prep

Before Starting

Honestly, getting all of your required documents to file your return is the most tedious and complicated part of the process. Once you have all the necessary papers in front of you, it's just a matter of filling in the blanks. And while the new standard deduction increase may knock a lot of people out of itemizing deductions, you still want to have everything on hand before you start filing your return. NerdWallet has prepared the ultimate Tax Prep Checklist on what you need; from last year's taxes and income documents to any big expenses or donations you're planning to claim.

There's

No Need

to Go Pro

If you don't already have a tax attorney, you likely don't need to have a paid preparer handle your return. Nearly 45% of Americans now file their taxes from home using tax preparation software. This is an excellent strategy, since the software will fully incorporate all tax changes for 2019. You get walked through the steps, answer the questions and the software handles all the technicalities for you. Of course, there are plenty of options when it comes to the software, so we'll refer you to DoughRoller, who compared six of the best tax return software programs on the market, from TurboTax and H&R Block to Tax Slayer.

Note: To get your tax return as fast as possible, file electronically and choose to have your return directly deposited for free into your bank account. The IRS issues more than 9 out of 10 refunds in less than 21 days.

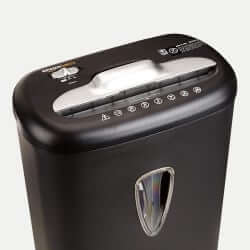

The Ultimate Tax Season Tool

Now's the time to shred any old documents you don't plan to keep. The IRS suggests keeping tax returns along with any supporting documents for three years following the date you filed. Depending on the task at hand, you can get a sturdy (but bulky) machine or a handheld (yet therapeutic) device. Amazon Basic's well-reviewed shredder can devour multiple pages and credit cards. But Muji's unique handheld shredder makes quick work of old bills, pay stubs and bank documents with a few flicks of the wrist.

Handy shredder,

$15 by Muji

8-sheet cross cut and credit card shredder,

$41.99 by Amazon Basics